What is compound interest?

When people think of interest, they often think of debt. But interest can work in your favor when you’re earning it on money you’ve saved and invested.

Compound interest can be defined as interest calculated on the initial principal and also on the accumulated interest of previous periods. Think of it as the cycle of earning “interest on interest” which can cause wealth to rapidly snowball. Compound Interest will make a deposit or loan grow at a faster rate than simple interest, which is interest calculated only on the principal amount.

Not only are you getting interest on your initial investment, but you are getting interest on top of interest! It’s because of this that your wealth can grow exponentially through compound interest, and why the idea of compounding returns is like putting your money to work for you.

Why is it important to save now?

The magic ingredient that makes compound interest work best is time.

The simple fact is that WHEN you start saving outweighs how much you save.

An investment left untouched for a period of decades can add up to a large sum, even if you never invest another dime.

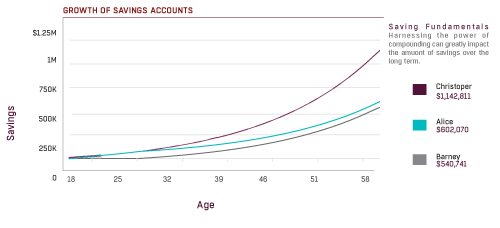

Let’s see how compound interest works with an example. Below, Alice, Barney and Christopher experience the exact same 7% annual investment return* on their retirement funds. The only difference is when and how often they save:

- Alice invests $5,000 per year beginning at age 18. At age 28, she stops. She has invested for 10 years and $50,000 total.

- Barney invests the same $5,000 but begins where Alice left off. He begins investing at age 28 and continues the annual $5,000 investment until he retires at age 58. Barney has invested for 30 years and $150,000 total.

- Christopher is our most diligent saver. He invests $5,000 per year beginning at age 18 and continues investing until retirement at age 58. He has invested for 40 years and a total of $200,000.

Barney has invested 3 times as much as Alice, yet Alice’s account has a higher value. She saved for just 10 years while Barney saved for 30 years. This is compound interest: the investment return that Alice earned in her 10 early years of saving is snowballing. The effect is so drastic that Barney can’t catch up, even if he saves for an additional 20 years.

The best scenario here is Christopher, who begins saving early and never stops. Note how the amount he has saved is massively higher than either Alice or Barney. Is it so astounding that Christopher’s savings have grown so large? Not necessarily – what is most remarkable is how simple his path to riches was. Slow and steady annual investments, and most importantly beginning at an early age.

Compound interest favors those that start early, which is why it pays to start now. It’s never too late to start — or too early.

If you are early in your career, it can feel like there are a lot of things competing for your money between student loans, saving for a house, retirement and more. However, saving now can give you a huge edge on your finances so you can retire stress-free. Also, if you are saving for your child’s education, the power of compound interest surely applies. Start saving when they are in diapers and not as they are starting their college search.